Navigating the 2024 Government Pay Period Calendar: A Finest, Magnificent, and Coruscating Guide

Related Articles: Navigating the 2024 Government Pay Period Calendar: A Finest, Magnificent, and Coruscating Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2024 Government Pay Period Calendar: A Finest, Magnificent, and Coruscating Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2024 Government Pay Period Calendar: A Finest, Magnificent, and Coruscating Guide

The government’s pay period calendar is a crucial document for millions of federal, state, and local government employees. It dictates when salaries are deposited, impacting personal financial planning, budgeting, and overall financial well-being. While seemingly straightforward, understanding the nuances of the calendar – especially its intricacies regarding holidays, paydays, and potential variations across different jurisdictions – can be surprisingly complex. This comprehensive guide aims to illuminate the 2024 government pay period calendar, offering a finest, magnificent, and coruscating exploration of its key aspects.

Understanding the Foundation: Pay Periods and Paydays

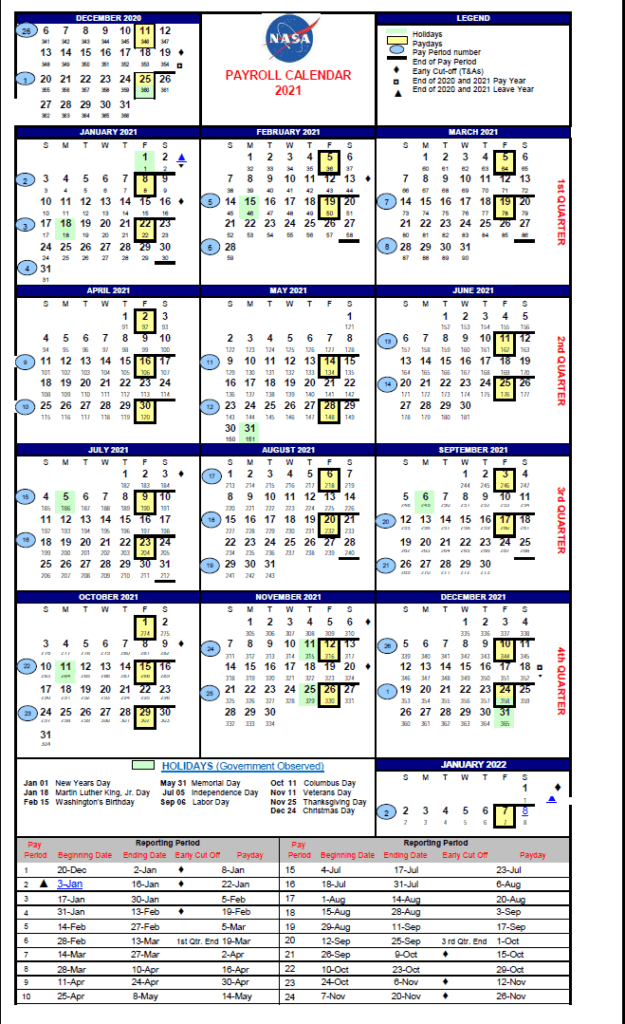

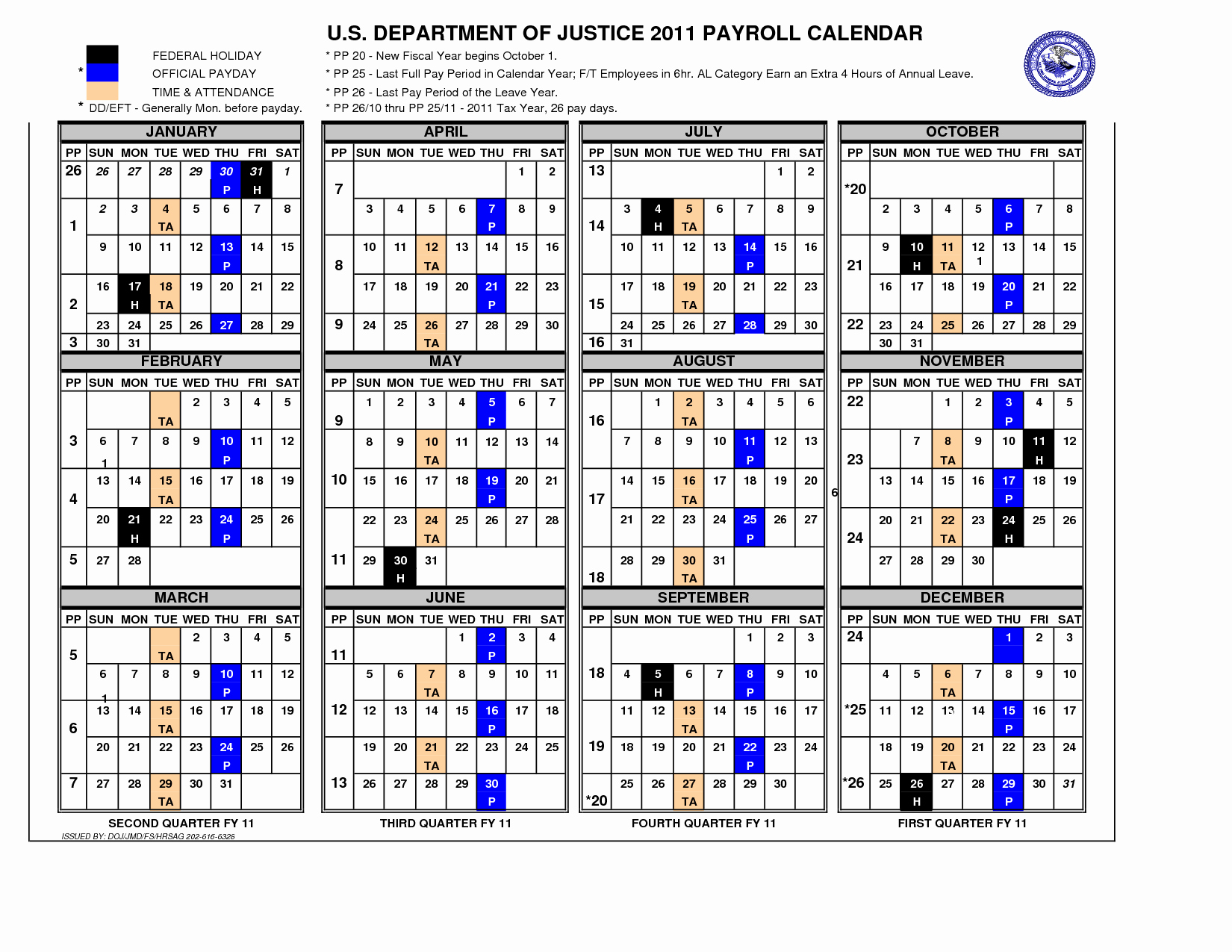

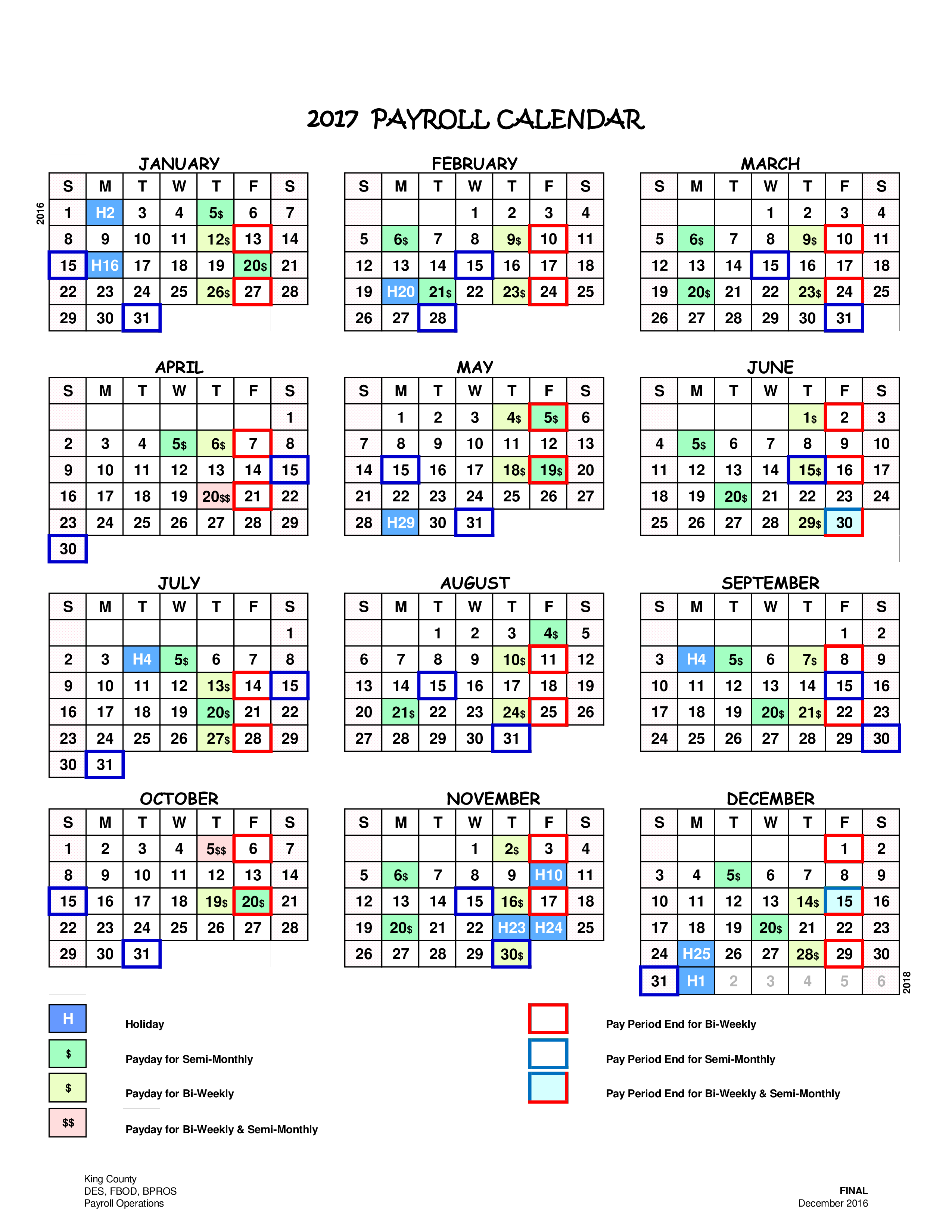

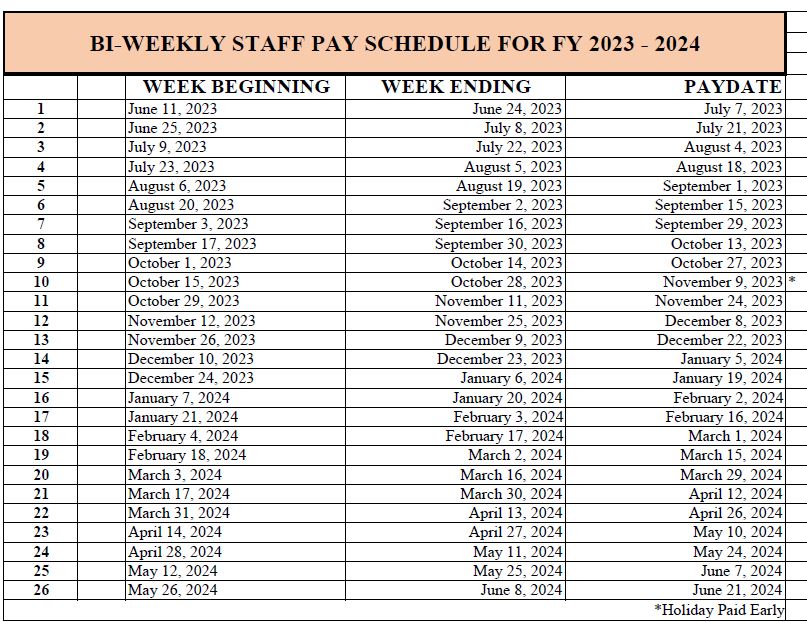

Before diving into the specifics of the 2024 calendar, let’s establish a foundational understanding. Most government agencies operate on a bi-weekly pay schedule, meaning employees receive their salaries twice a month. This contrasts with monthly or weekly pay cycles common in the private sector. The exact dates of paydays, however, are not arbitrary. They are meticulously calculated based on a predetermined pay period calendar, which typically spans a full fiscal year (October 1st to September 30th for the federal government, though state and local governments may vary).

The pay period calendar is not simply a list of paydays. It defines specific pay periods, each with a unique identification number or range of dates. This is crucial for accurate payroll processing, timekeeping, and leave accounting. Each pay period encompasses a specific number of working days, and the payday typically falls within a few days after the period’s conclusion.

The 2024 Government Pay Period Calendar: Key Considerations

The 2024 government pay period calendar, while specific to each jurisdiction (federal, state, local), shares common characteristics. Its design accounts for several factors:

-

Federal Holidays: These federally recognized holidays directly impact the pay period calendar. If a pay period includes a holiday, the payday might shift slightly to accommodate the non-working day. The 2024 federal holidays include New Year’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, and Christmas. State and local governments may observe additional holidays, further influencing their respective calendars.

-

Weekends: Weekends are naturally excluded from working days and consequently influence the length and ending dates of pay periods. Pay periods are structured to avoid ending on weekends, leading to potential variations in payday dates throughout the year.

-

Leap Year: 2024 is a leap year, adding an extra day (February 29th) to the calendar. This minor adjustment necessitates a recalibration of the pay period calendar to ensure consistent bi-weekly pay cycles. While seemingly insignificant, this adjustment requires careful planning and precise calculation to avoid payroll discrepancies.

-

Payroll Processing Time: The actual processing of payroll takes time. While the pay period ends on a specific date, the payday itself might fall a few days later to allow for accurate calculation, data entry, and electronic transfer of funds. This lag time is a consistent factor across all government pay schedules.

-

Jurisdictional Variations: It’s crucial to emphasize the variations across different government levels. The federal government’s pay period calendar will differ from those of individual states and municipalities. Each jurisdiction maintains its own calendar, reflecting its specific holiday schedule, working days, and payroll processing procedures. Employees must consult the calendar specific to their employing agency.

Accessing the 2024 Calendar: A Guide to Information Sources

Finding the precise 2024 government pay period calendar requires targeted searching. Here’s a breakdown of reliable information sources:

-

Federal Government: For federal employees, the Office of Personnel Management (OPM) website is the primary source. Their website typically publishes the calendar well in advance of the new year, allowing for ample planning. Look for specific sections dedicated to payroll and human resources.

-

State Governments: State government employees should consult their respective state’s human resources or payroll department websites. Many states publish their calendars online, often within their employee portals or dedicated financial sections.

-

Local Governments: Local government pay calendars are typically available through the city, county, or municipal website’s human resources or finance department pages. Contacting the payroll office directly is another effective method.

-

Employee Handbooks and Intranets: Many government agencies provide their employees with access to the pay period calendar through internal resources like employee handbooks or intranet portals. These internal sources often offer the most readily accessible and up-to-date information.

Magnificent Applications and Coruscating Implications

Understanding the 2024 government pay period calendar extends far beyond simply knowing when your paycheck arrives. It has significant implications for:

-

Budgeting and Financial Planning: Accurate knowledge of payday dates allows for meticulous budgeting, enabling employees to anticipate income and plan expenses accordingly. This is especially crucial for managing debts, saving for major purchases, or investing.

-

Leave Planning: The calendar helps in planning leave requests effectively. Understanding pay period boundaries ensures accurate calculation of accrued leave and avoids potential payroll complications arising from leave overlapping pay periods.

-

Tax Planning: Knowing the precise timing of paydays facilitates accurate tax planning and filing. This allows for better management of tax liabilities and avoids potential penalties.

-

Debt Management: The calendar helps manage debt repayment schedules, ensuring timely payments and avoiding late payment fees. Synchronizing paydays with debt repayment deadlines optimizes financial stability.

-

Investment Strategies: Knowing the exact dates of income allows for the strategic timing of investments, maximizing returns and minimizing risks.

Conclusion: A Shining Beacon in Financial Navigation

The 2024 government pay period calendar, while seemingly a simple document, serves as a crucial tool for financial planning and stability for millions of government employees. Its meticulous design, accounting for holidays, weekends, and jurisdictional variations, underscores its importance. By actively seeking and understanding the specifics of the calendar relevant to their employment, government workers can navigate their finances with confidence, ensuring a brighter and more secure financial future. This guide aims to serve as a finest, magnificent, and coruscating beacon, illuminating the path towards effective financial management using the 2024 government pay period calendar as a key navigational tool. Remember to always consult the official calendar published by your employing agency for the most accurate and up-to-date information.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2024 Government Pay Period Calendar: A Finest, Magnificent, and Coruscating Guide. We appreciate your attention to our article. See you in our next article!