Discover it® Cash Back Calendar: Unlocking the Ultimate Prime Rewards in 2024

Related Articles: Discover it® Cash Back Calendar: Unlocking the Ultimate Prime Rewards in 2024

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Discover it® Cash Back Calendar: Unlocking the Ultimate Prime Rewards in 2024. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Discover it® Cash Back Calendar: Unlocking the Ultimate Prime Rewards in 2024

The Discover it® Cash Back calendar has become a staple for savvy consumers seeking to maximize their rewards. Its rotating quarterly categories, coupled with the generous introductory offer and unmatched features, consistently places it at the top of many best-cash-back-card lists. But the 2024 calendar promises to be even better, offering an unprecedented opportunity to accumulate significant cash back on everyday spending. This in-depth article will delve into the intricacies of the Discover it® Cash Back calendar for 2024, exploring its potential, maximizing its benefits, and comparing it to other leading cash-back credit cards.

Understanding the 2024 Discover it® Cash Back Calendar Structure:

The core of the Discover it® Cash Back card’s appeal lies in its dynamic quarterly bonus categories. Unlike cards with static rewards structures, Discover rotates these categories, ensuring that you can consistently earn higher cash back on items you regularly purchase. While the specific categories for 2024 are typically announced closer to the start of each quarter, we can anticipate a similar pattern to previous years, offering a mix of popular spending areas such as:

-

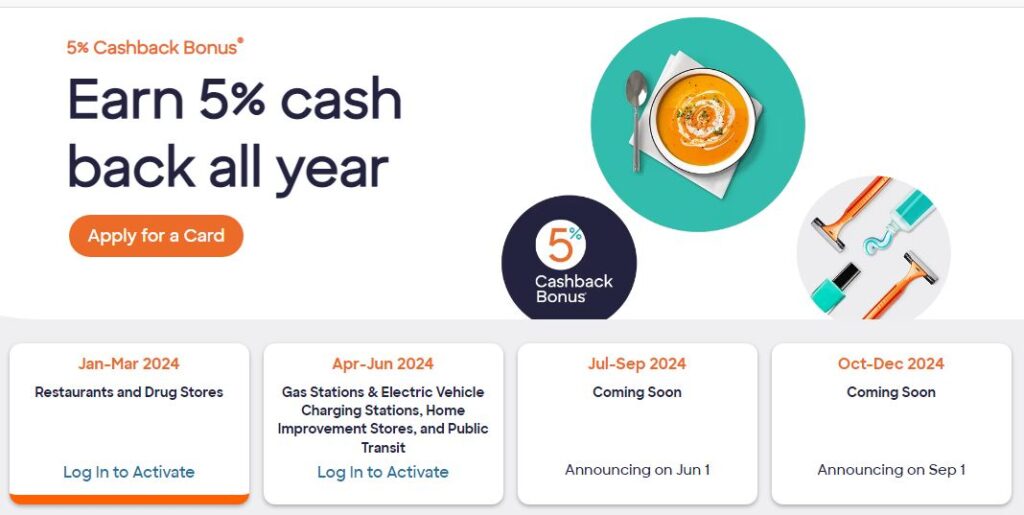

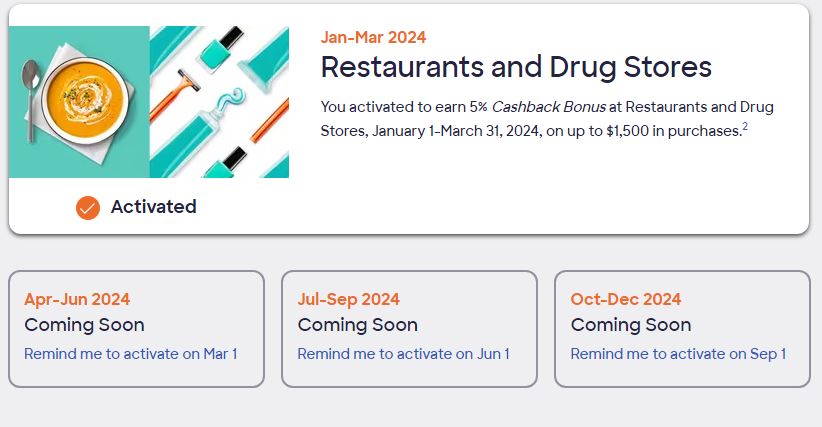

Rotating 5% Cash Back Categories: This is the cornerstone of the Discover it® Cash Back card. Each calendar quarter (January-March, April-June, July-September, October-December), Discover selects four distinct spending categories where cardholders earn a generous 5% cash back on up to $1,500 in combined purchases. Past categories have included grocery stores, restaurants, gas stations, Amazon purchases, and various online retailers. The key is to plan your spending strategically to align with these rotating categories.

-

Unlimited 1% Cash Back on All Other Purchases: Even outside the rotating 5% categories, you still earn a respectable 1% cash back on all other purchases you make with your Discover it® Cash Back card. This provides a consistent base level of rewards regardless of the quarterly promotions.

-

Annual Match: This is where the Discover it® Cash Back card truly shines. At the end of your first year, Discover automatically matches all the cash back you’ve earned – doubling your rewards! This effectively boosts your overall return, making it a highly lucrative option for new cardholders.

Strategic Planning for Maximum 2024 Rewards:

The key to unlocking the "Ultimate Prime" experience with the Discover it® Cash Back card lies in proactive planning. Once the 2024 calendar is officially released, carefully analyze the categories and adjust your spending habits accordingly. Consider these strategies:

-

Track Spending Habits: Before the new year begins, review your spending patterns from the past year. Identify areas where you consistently spend significant amounts of money. This will help you anticipate which quarterly categories will be most beneficial to you.

-

Shift Purchases: If a category you frequently spend in (e.g., groceries) aligns with a 5% cash back quarter, try to consolidate your purchases during that period. This could involve stocking up on non-perishable items or shifting larger grocery runs to coincide with the promotional period.

-

Utilize Online Shopping Portals: Many online retailers offer additional cash back through third-party platforms. Combining these portals with the Discover it® Cash Back card’s 5% cash back on eligible online purchases can significantly amplify your rewards.

-

Automate Payments: Ensure you always pay your balance in full and on time to avoid interest charges, which can quickly negate the benefits of cash back rewards. Setting up automatic payments can help prevent late payments and maintain a healthy credit score.

-

Monitor Your Account: Regularly check your Discover account to ensure your cash back is accurately tracked and to stay updated on any changes to the rewards program.

Comparing Discover it® Cash Back to Competitors:

The Discover it® Cash Back card stands out in the competitive landscape of cash-back credit cards due to its unique combination of features:

-

Rotating 5% Cash Back vs. Static Rewards: Many competing cards offer a fixed percentage of cash back on specific categories (e.g., 2% on groceries, 1% on everything else). The Discover it® Cash Back card’s rotating categories provide greater flexibility and the potential for higher overall returns if you strategically align your spending.

-

Annual Match vs. Other Bonuses: While some competitors offer sign-up bonuses, the Discover it® Cash Back card’s annual match is a unique and highly valuable feature, effectively doubling your rewards for the first year.

-

No Annual Fee: Many premium cash-back cards charge annual fees. The Discover it® Cash Back card’s lack of an annual fee makes it accessible to a wider range of consumers.

-

Excellent Customer Service: Discover consistently receives high marks for its customer service, providing a positive experience for cardholders.

Beyond the Cash Back: Additional Benefits of the Discover it® Cash Back Card:

The Discover it® Cash Back card offers more than just its impressive cash-back program. Consider these additional benefits:

-

Fraud Protection: Discover provides robust fraud protection, safeguarding your account from unauthorized transactions.

-

Zero Liability Protection: Discover’s zero liability policy ensures you won’t be held responsible for unauthorized charges made on your card.

-

Online Account Management: Managing your account online is easy and convenient, allowing you to track spending, monitor rewards, and make payments with ease.

-

Mobile App: The Discover app offers a seamless mobile experience for managing your account and accessing your rewards.

Conclusion: Maximizing Your 2024 Financial Potential with Discover it® Cash Back:

The Discover it® Cash Back card, with its dynamic 2024 calendar and generous rewards structure, presents a compelling opportunity to maximize your cash back earnings. By carefully planning your spending, understanding the rotating categories, and leveraging the annual match, you can significantly boost your financial returns. While the specific categories for 2024 remain to be announced, the proven success of the previous years’ calendars suggests another year of lucrative rewards potential. By combining strategic planning with the card’s inherent benefits, you can unlock the "Ultimate Prime" rewards experience and make the most of your financial resources in 2024. Remember to always read the terms and conditions carefully and compare it to other cards to ensure it fits your spending habits and financial goals. The Discover it® Cash Back card, however, remains a strong contender for those seeking a rewarding and flexible credit card option.

.jpg)

Closure

Thus, we hope this article has provided valuable insights into Discover it® Cash Back Calendar: Unlocking the Ultimate Prime Rewards in 2024. We thank you for taking the time to read this article. See you in our next article!