Decoding the CCSD Licensed Payroll Calendar 2020-2021: A Comprehensive Guide

Related Articles: Decoding the CCSD Licensed Payroll Calendar 2020-2021: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Decoding the CCSD Licensed Payroll Calendar 2020-2021: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Decoding the CCSD Licensed Payroll Calendar 2020-2021: A Comprehensive Guide

The Clark County School District (CCSD) in Nevada, one of the largest school districts in the United States, employs a complex payroll system to manage the compensation of its vast workforce. Understanding the intricacies of the CCSD licensed payroll calendar for the 2020-2021 school year is crucial for all licensed employees, from teachers and counselors to administrators and specialists. This article delves deep into the nuances of that calendar, exploring its structure, key dates, implications for budgeting and financial planning, and frequently asked questions. While we cannot provide the exact calendar itself (as it’s an internal document), we can analyze the typical components and challenges associated with such a system.

Understanding the Structure of a Typical CCSD Licensed Payroll Calendar:

A typical CCSD licensed payroll calendar for a school year like 2020-2021 would be structured around the academic calendar, incorporating key dates like the start and end of school, holidays, and professional development days. Unlike a standard monthly payroll, it often features a schedule tailored to the unique rhythm of the educational year. Key features would include:

-

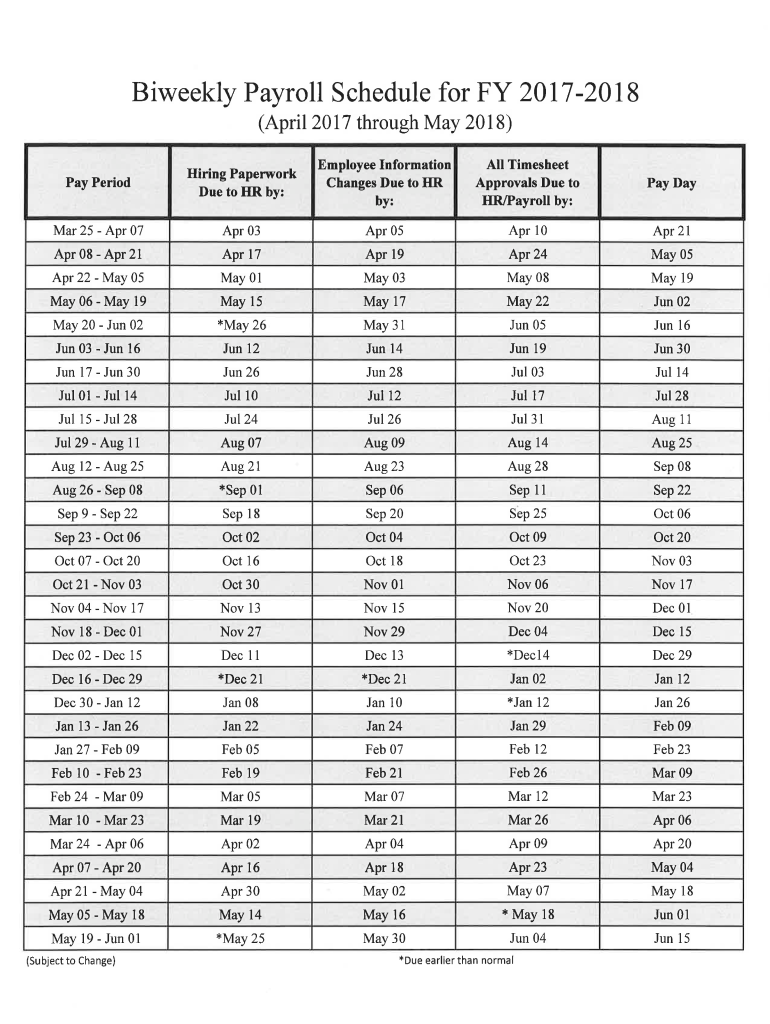

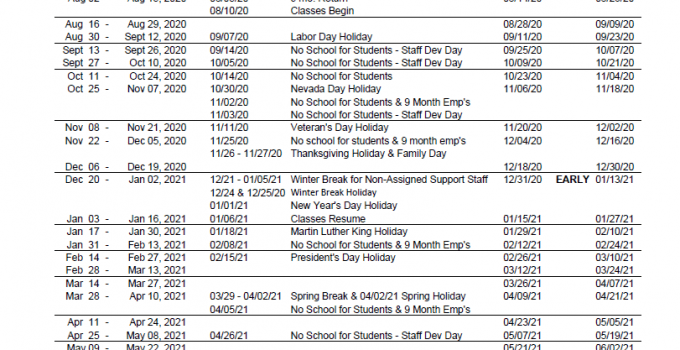

Pay Periods: The calendar would define distinct pay periods, likely bi-weekly or semi-monthly. Each pay period would have a specific start and end date, determining the time frame for which employees are compensated.

-

Pay Dates: Crucially, the calendar would specify the exact date on which employees receive their paychecks. These dates are critical for budgeting and financial planning. Delays in payroll can have significant consequences for employees.

-

Holiday Pay: The calendar would clearly indicate any holidays falling within a pay period, specifying whether employees receive pay for these days (often pro-rated based on their contract) or not.

-

Professional Development Days: These days, dedicated to teacher training and professional growth, would also be incorporated. The calendar would indicate whether these days are paid or unpaid, a critical aspect of compensation.

-

Summer Pay: The summer months typically involve a different payroll schedule than the academic year. The calendar would detail how summer pay is distributed, potentially involving a reduced number of paychecks or a different pay period structure.

-

Contractual Obligations: The payroll calendar would align with the contractual obligations of licensed employees, ensuring that compensation is accurately reflected in accordance with their employment agreements.

Challenges and Considerations for the 2020-2021 Calendar:

The 2020-2021 school year presented unique challenges due to the COVID-19 pandemic. The CCSD licensed payroll calendar likely had to adapt to the following:

-

Remote Learning: The shift to remote learning could have affected the timing of paychecks, especially if it impacted the number of working days.

-

School Closures and Delays: Unexpected school closures or delays due to the pandemic would necessitate adjustments to the payroll schedule, requiring careful coordination between the payroll department and school administration.

-

Increased Administrative Burden: Managing payroll during a pandemic likely placed an increased burden on the CCSD payroll department, requiring them to adapt quickly and efficiently to changing circumstances.

-

Health and Safety Measures: The implementation of health and safety measures could have indirectly impacted the payroll calendar, particularly if it led to changes in working hours or staffing levels.

-

Federal and State Funding Changes: Changes in federal and state funding related to COVID-19 relief could have impacted the timing and amount of payroll disbursements.

Impact on Budgeting and Financial Planning:

The accuracy and timeliness of the CCSD licensed payroll calendar were crucial for employees’ financial planning. A well-structured calendar allows employees to:

-

Budget Effectively: Knowing the exact pay dates allows for accurate budgeting of expenses, ensuring that bills are paid on time and avoiding financial hardship.

-

Plan for Major Purchases: The calendar aids in planning for significant purchases, such as a car or a home, by providing a clear understanding of available funds.

-

Manage Debt: Accurate knowledge of income allows for effective debt management, preventing late payments and damaging credit scores.

-

Save for Retirement and Other Goals: Consistent income allows employees to contribute regularly to retirement plans and savings accounts, helping them achieve long-term financial goals.

Frequently Asked Questions (FAQs):

While we can’t provide specific answers related to the 2020-2021 CCSD calendar, here are some frequently asked questions about licensed employee payroll in general:

-

Q: Where can I find the exact payroll calendar? A: The official payroll calendar is typically distributed internally through the CCSD human resources department or employee portal. Contact your HR representative for access.

-

Q: What happens if my paycheck is late? A: Contact the CCSD payroll department immediately to report the issue. They will investigate and rectify the problem.

-

Q: How are taxes deducted from my paycheck? A: Taxes are deducted according to federal and state regulations, as well as any local taxes applicable. Your pay stub will provide a detailed breakdown of deductions.

-

Q: What if I have a change in my banking information? A: Notify the CCSD payroll department promptly to update your banking details to ensure your paycheck is deposited correctly.

-

Q: How do I report a payroll error? A: Follow the established procedures within the CCSD system for reporting payroll errors. This usually involves contacting the payroll department directly or submitting a formal request through the employee portal.

Conclusion:

The CCSD licensed payroll calendar for the 2020-2021 school year, while unavailable for direct review here, was a critical document for thousands of employees. Understanding its structure, key dates, and potential challenges due to the pandemic is essential for appreciating the complex logistics involved in managing payroll for such a large organization. Accurate and timely payroll is not only vital for the financial well-being of individual employees but also for the overall smooth functioning of the CCSD. By understanding the key elements discussed in this article, licensed employees can better navigate the system and ensure their financial stability. Always refer to official CCSD communications and contact the payroll department directly for any specific questions or concerns regarding your compensation.

Closure

Thus, we hope this article has provided valuable insights into Decoding the CCSD Licensed Payroll Calendar 2020-2021: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!