Navigating the 2024 Bi-Weekly Friday Pay Calendar: An Innovative Approach to Payroll Management

Related Articles: Navigating the 2024 Bi-Weekly Friday Pay Calendar: An Innovative Approach to Payroll Management

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2024 Bi-Weekly Friday Pay Calendar: An Innovative Approach to Payroll Management. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2024 Bi-Weekly Friday Pay Calendar: An Innovative Approach to Payroll Management

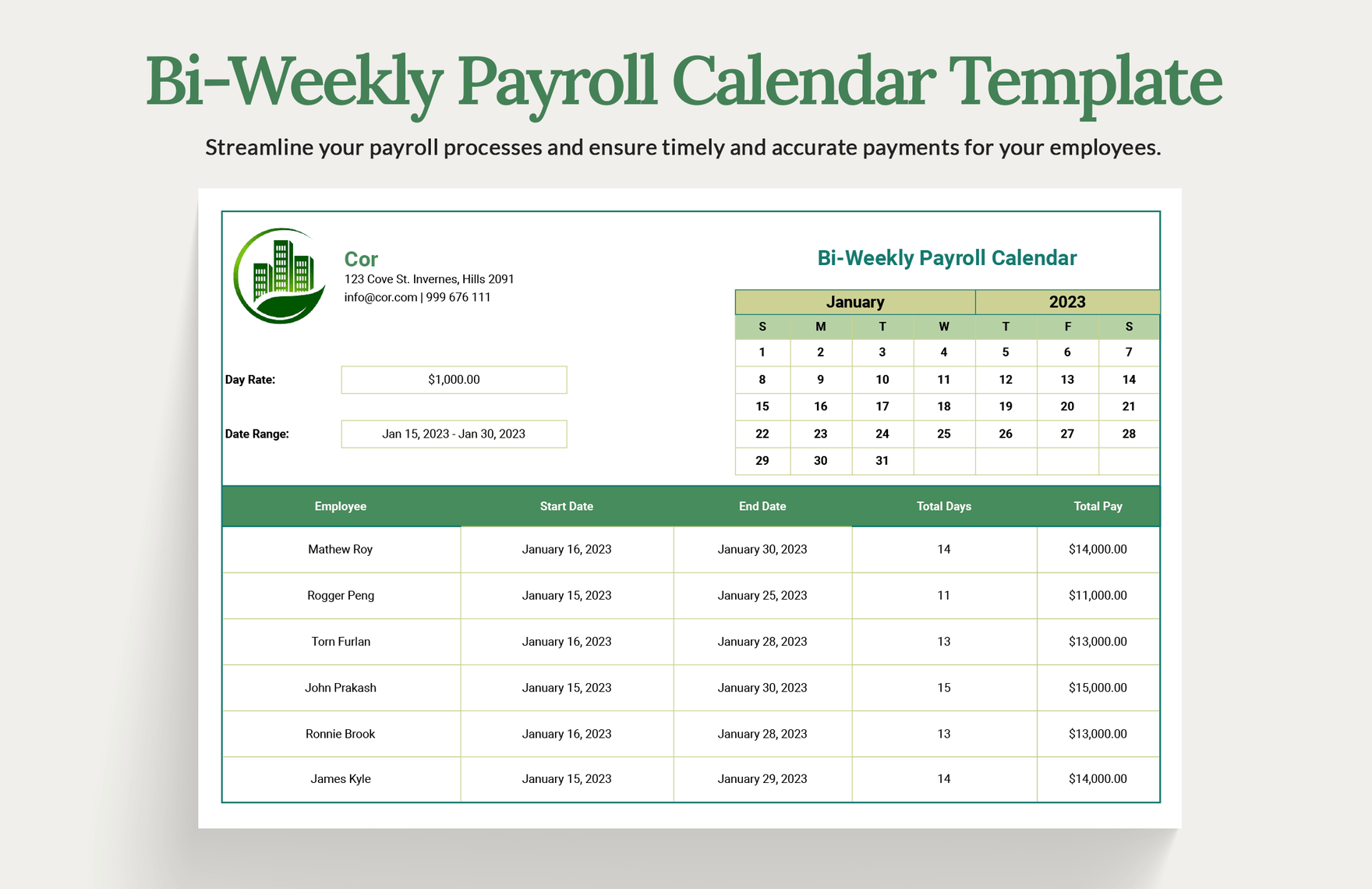

The efficient and accurate processing of payroll is a cornerstone of any successful organization. For businesses operating on a bi-weekly Friday pay schedule, meticulous planning and a clear understanding of the calendar are crucial. 2024 presents its own unique challenges, with varying numbers of days in different months and the ever-present need for accuracy to maintain employee morale and avoid legal complications. This article delves into the complexities of a bi-weekly Friday pay calendar for 2024, offering innovative strategies, outstanding best practices, and superior solutions for seamless payroll management.

Understanding the Bi-Weekly Friday Pay Cycle:

A bi-weekly Friday pay cycle means employees receive their wages every other Friday. This differs from a semi-monthly system, which pays twice a month on pre-determined dates. The bi-weekly system, while seemingly simpler, requires careful attention to detail because the pay period start and end dates shift throughout the year, influenced by the varying lengths of months. This shifting necessitates a robust system for accurate calculation of hours worked, deductions, and net pay.

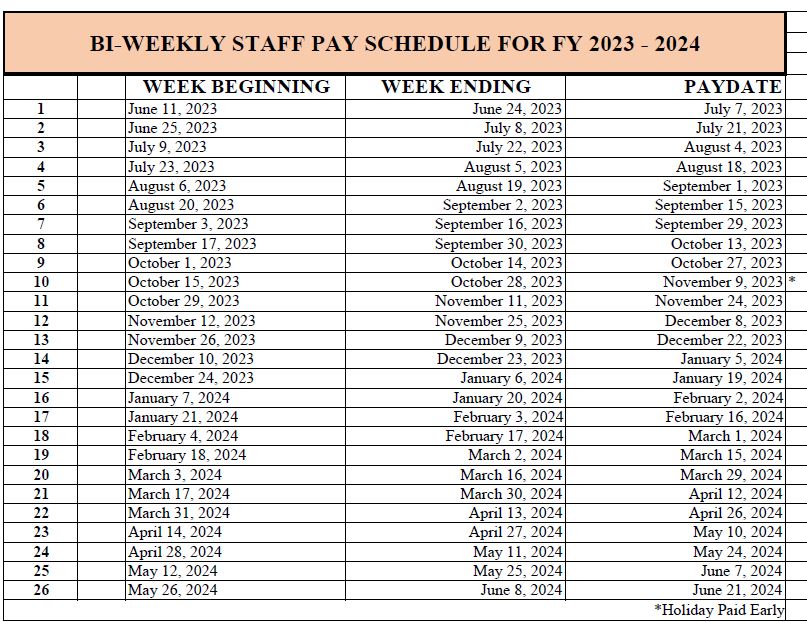

The 2024 Bi-Weekly Friday Pay Calendar: A Detailed Look:

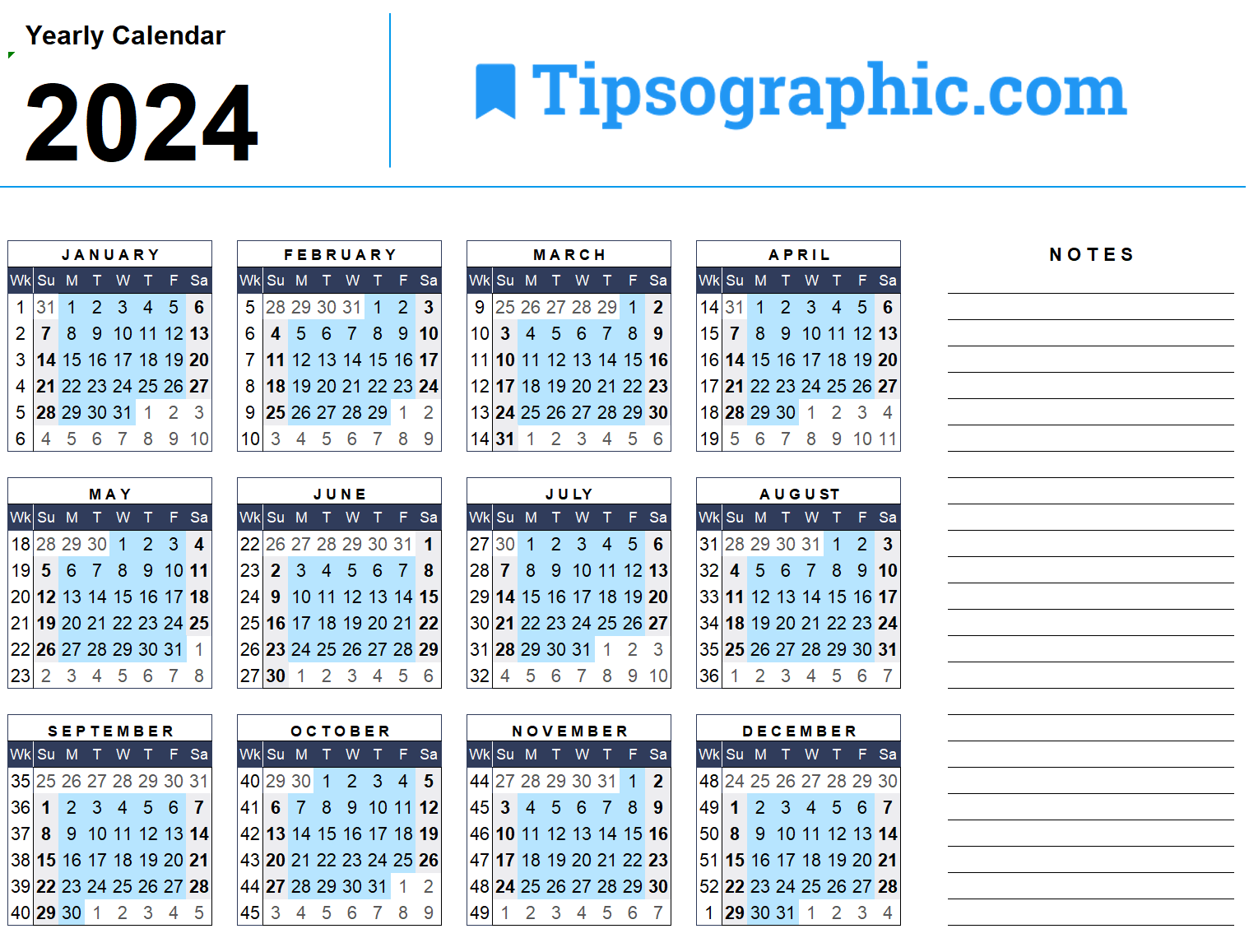

Creating a comprehensive 2024 bi-weekly Friday pay calendar involves identifying the first pay period and then consistently calculating subsequent pay periods. Let’s assume the first pay period of 2024 begins on Sunday, December 31st, 2023, and ends on Friday, January 12th, 2024. This approach ensures consistency across the year. The following table illustrates a sample of the 2024 bi-weekly Friday pay calendar based on this starting point. (Note: This is a sample and may need adjustment depending on your specific company’s payroll start date.)

| Pay Period | Start Date | End Date | Pay Date |

|---|---|---|---|

| 1 | Dec 31, 2023 | Jan 12, 2024 | Jan 12, 2024 |

| 2 | Jan 13, 2024 | Jan 26, 2024 | Jan 26, 2024 |

| 3 | Jan 27, 2024 | Feb 9, 2024 | Feb 9, 2024 |

| 4 | Feb 10, 2024 | Feb 23, 2024 | Feb 23, 2024 |

| 5 | Feb 24, 2024 | Mar 8, 2024 | Mar 8, 2024 |

| 6 | Mar 9, 2024 | Mar 22, 2024 | Mar 22, 2024 |

| 7 | Mar 23, 2024 | Apr 5, 2024 | Apr 5, 2024 |

| … | … | … | … |

This table should be extended to cover all 26 pay periods in 2024. Remember to carefully calculate the dates, accounting for leap year and the varying number of days in each month. Using a spreadsheet program like Excel or Google Sheets is highly recommended for this task, allowing for easy calculation and modification.

Innovative Strategies for Seamless Payroll Management:

Implementing a bi-weekly Friday pay calendar requires more than just a calendar; it requires a strategic approach to ensure accuracy and efficiency. Here are some innovative strategies:

-

Automated Payroll Systems: Investing in automated payroll software is crucial. These systems integrate with time and attendance tracking, reducing manual data entry errors and speeding up the processing time. They can also automatically calculate taxes, deductions, and net pay, minimizing the risk of human error.

-

Cloud-Based Solutions: Cloud-based payroll systems offer accessibility from anywhere with an internet connection, allowing for flexibility and collaboration. They also often include features like automated reporting and analytics, providing valuable insights into payroll costs and trends.

-

Time and Attendance Tracking Integration: Seamless integration between time and attendance systems and the payroll system is paramount. This ensures accurate recording of hours worked, overtime, and other compensation elements. Consider systems with biometric or GPS tracking for enhanced accuracy.

-

Data Validation and Error Checking: Implementing robust data validation and error-checking mechanisms within the payroll system is crucial. This minimizes errors and ensures data integrity. Regular audits of payroll data should also be conducted to identify and rectify any discrepancies.

Outstanding Best Practices for Accuracy and Compliance:

Maintaining accuracy and compliance is paramount in payroll management. Here are some outstanding best practices:

-

Regular Data Backups: Regular backups of payroll data are essential to protect against data loss due to system failures or other unforeseen events. Cloud-based systems often handle backups automatically, but it’s crucial to verify this functionality.

-

Strict Adherence to Labor Laws: Payroll processes must strictly adhere to all applicable federal, state, and local labor laws. This includes accurate calculation of taxes, minimum wage compliance, and adherence to overtime regulations. Staying updated on changes in labor laws is crucial.

-

Employee Self-Service Portals: Providing employees with access to a self-service portal allows them to view their pay stubs, W-2s, and other payroll-related information online. This improves transparency and reduces the burden on the payroll department.

-

Regular Training for Payroll Staff: Regular training for payroll staff ensures they are up-to-date on the latest payroll regulations, software updates, and best practices. This minimizes errors and maintains compliance.

Superior Solutions for Enhanced Efficiency:

To achieve superior efficiency in managing a bi-weekly Friday pay calendar, consider these solutions:

-

Predictive Payroll Analytics: Utilize payroll analytics to predict future payroll costs and identify potential areas for improvement. This allows for proactive budget planning and resource allocation.

-

Mobile Payroll Access: Provide employees with mobile access to their pay stubs and other payroll information through a dedicated mobile app. This enhances employee satisfaction and improves communication.

-

Integration with HR Systems: Integrating the payroll system with the HR system streamlines employee onboarding and offboarding processes, ensuring accurate payroll data from the start.

-

Robust Reporting and Analytics: Utilize comprehensive reporting and analytics features to track key payroll metrics, identify trends, and make data-driven decisions.

Conclusion:

Effectively managing a bi-weekly Friday pay calendar in 2024 requires a strategic and innovative approach. By leveraging automated payroll systems, cloud-based solutions, robust data validation techniques, and best practices for accuracy and compliance, organizations can ensure seamless payroll processing, maintain employee satisfaction, and avoid costly errors. The implementation of superior solutions, such as predictive analytics and mobile access, further enhances efficiency and transparency, ultimately contributing to a more streamlined and successful business operation. Remember that accuracy and compliance are paramount, and regular review and updates to your payroll processes are vital to staying ahead of the curve. A well-managed payroll system is not just a cost-effective operation; it’s a critical component of a thriving and productive workforce.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2024 Bi-Weekly Friday Pay Calendar: An Innovative Approach to Payroll Management. We thank you for taking the time to read this article. See you in our next article!