The Calendar Year-End Reporting Period: A Conclusive Consequent Certain

Related Articles: The Calendar Year-End Reporting Period: A Conclusive Consequent Certain

Introduction

With great pleasure, we will explore the intriguing topic related to The Calendar Year-End Reporting Period: A Conclusive Consequent Certain. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Calendar Year-End Reporting Period: A Conclusive Consequent Certain

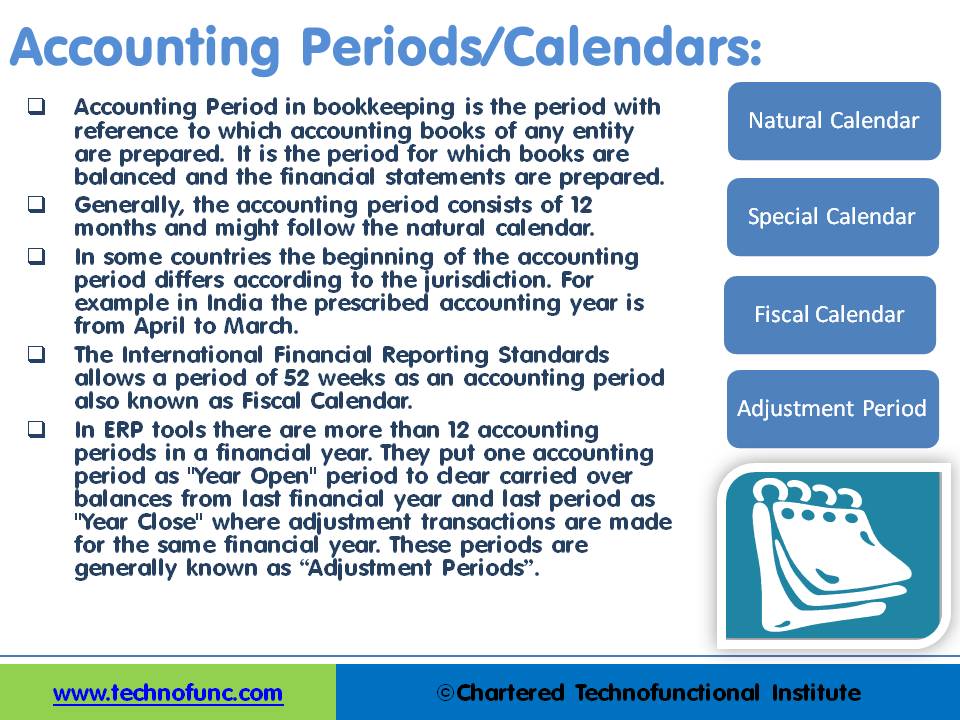

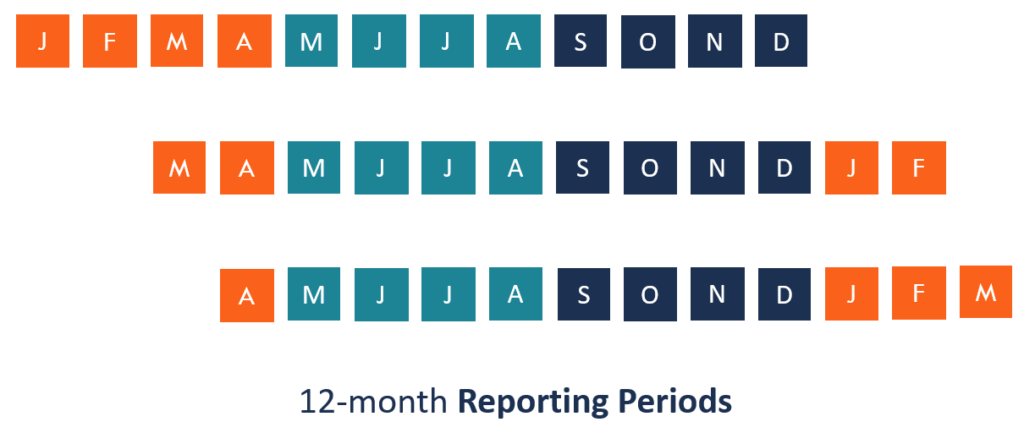

The end of a calendar year marks more than just the passage of time; for businesses, governments, and individuals alike, it signifies a crucial juncture for accounting, analysis, and strategic planning. This period, the calendar year-end reporting period, can be defined as a conclusive consequent certain, a phrase highlighting its definitive nature and the unavoidable consequences of its arrival. Let’s unpack this definition and explore the implications of this critical timeframe.

Conclusive: The year-end reporting period is conclusive because it represents the finalization of a specific accounting cycle. All transactions, events, and activities undertaken during the preceding twelve months are brought together, reviewed, audited (in many cases), and summarized. This process concludes the financial reporting cycle for that particular year, providing a complete and comprehensive picture of the entity’s financial performance and position. There’s a sense of finality; the data is set, and adjustments are limited to corrections of errors or omissions, not fundamental alterations to the overall picture. This conclusiveness is critical for stakeholders who rely on this information for informed decision-making.

Consequent: The year-end reporting period is consequent because it triggers a cascade of subsequent actions and events. The finalized reports directly influence a multitude of decisions and activities, both internally and externally. Internally, the reports inform strategic planning for the upcoming year, allowing businesses to identify areas of strength and weakness, adjust strategies, and allocate resources effectively. Performance reviews, bonus calculations, and internal budget adjustments are all consequences of the year-end reporting. Externally, the reports are crucial for communicating financial performance to investors, creditors, regulators, and other stakeholders. These reports influence investment decisions, credit ratings, regulatory compliance, and the overall perception of the entity’s financial health. The consequences extend far beyond the simple act of compiling the reports themselves.

Certain: The year-end reporting period is certain because it occurs on a predetermined and universally recognized date – December 31st. Unlike other reporting periods that might vary based on fiscal years or specific business cycles, the calendar year-end is fixed and predictable. This certainty allows for planning and preparation. Businesses can anticipate the reporting requirements well in advance, allocating resources and personnel to ensure accurate and timely completion. Investors and other stakeholders can also anticipate the release of these reports, allowing them to incorporate the information into their own planning and decision-making processes. This predictability reduces uncertainty and enhances the reliability of the financial information.

The Interplay of Conclusiveness, Consequence, and Certainty:

The three elements – conclusive, consequent, and certain – are intricately interwoven. The conclusiveness of the reporting period creates the foundation for its consequences. The finalized reports, representing a complete and definitive picture of the past year, are then used to inform a multitude of future decisions and actions. The certainty of the reporting date ensures that this process unfolds in a predictable and orderly manner, minimizing disruptions and maximizing the effectiveness of the information provided.

Implications Across Different Sectors:

The implications of the calendar year-end reporting period are far-reaching and vary across different sectors:

-

Businesses: For businesses, the year-end report is essential for evaluating performance, identifying areas for improvement, and making strategic adjustments. It’s crucial for securing funding, attracting investors, and maintaining a positive credit rating. Tax obligations are heavily reliant on these reports, making accurate and timely completion paramount.

-

Government: Governments utilize year-end reports to track budget performance, assess the effectiveness of public programs, and inform future policy decisions. These reports are essential for transparency and accountability to the public. Audits of government accounts often coincide with the calendar year-end.

-

Non-profit Organizations: Non-profits rely on year-end reports to demonstrate their impact to donors and funders, securing continued support for their missions. These reports are vital for maintaining their non-profit status and complying with regulatory requirements.

-

Individuals: While less formal, individuals also experience the consequences of the calendar year-end through tax filings, retirement account statements, and personal financial planning. The year-end provides an opportunity for reflection and planning for the year ahead.

Challenges and Considerations:

While the calendar year-end reporting period is a crucial and well-defined process, it also presents certain challenges:

-

Time Constraints: The compressed timeframe often leads to intense pressure on accounting and finance teams to complete the reporting process accurately and efficiently.

-

Data Accuracy: Ensuring the accuracy and completeness of the data used in the reports is paramount. Errors can have significant consequences for the entity and its stakeholders.

-

Regulatory Compliance: Meeting the ever-evolving regulatory requirements for financial reporting can be complex and demanding.

-

Technological Limitations: The sheer volume of data involved can strain existing technological infrastructure, requiring robust systems and processes to handle the information efficiently.

Conclusion:

The calendar year-end reporting period, defined as a conclusive consequent certain, is a critical event with far-reaching implications. Its conclusive nature provides a definitive snapshot of the past year’s activities, its consequent nature triggers a chain of actions and decisions, and its certainty allows for effective planning and preparation. Understanding the significance of this period and addressing the associated challenges is essential for businesses, governments, and individuals alike to make informed decisions, manage resources effectively, and navigate the complexities of the modern financial landscape. The year-end report is not merely an accounting exercise; it’s a cornerstone for strategic planning, accountability, and informed decision-making across all sectors. Its importance cannot be overstated, and its timely and accurate completion remains a critical task for organizations worldwide.

![[TOPIC 10] ACCOUNTING PERIOD Calendar Year, Fiscal Year, and the](https://i.ytimg.com/vi/SnhlblLi-0g/maxresdefault.jpg)

Closure

Thus, we hope this article has provided valuable insights into The Calendar Year-End Reporting Period: A Conclusive Consequent Certain. We appreciate your attention to our article. See you in our next article!